Federal Reserve Board – Federal Reserve Board releases hypothetical scenarios for its 2021 bank stress tests

Make sure you permit JavaScript if it is disabled in your browser or accessibility the facts as a result of the one-way links provided under.

February 12, 2021

Federal Reserve Board releases hypothetical situations for its 2021 financial institution tension exams

For launch at nine:fifteen a.m. EST

The Federal Reserve Board on Friday released the hypothetical situations for its 2021 financial institution tension exams. Last 12 months, the Board identified that significant banks ended up generally effectively capitalized less than a range of hypothetical events but because of to continuing economic uncertainty placed limits on financial institution payouts to maintain the power of the banking sector.

The Board’s tension exams help make certain that significant banks are able to lend to homes and businesses even in a extreme recession. The exercise evaluates the resilience of significant banks by estimating their financial loan losses and money levels—which present a cushion against losses—under hypothetical recession situations that lengthen nine quarters into the future.

“The banking sector has provided significant aid to the economic restoration in excess of the past 12 months. While uncertainty remains, this tension check will give the community further facts on its resilience,” Vice Chair for Supervision Randal K. Quarles said.

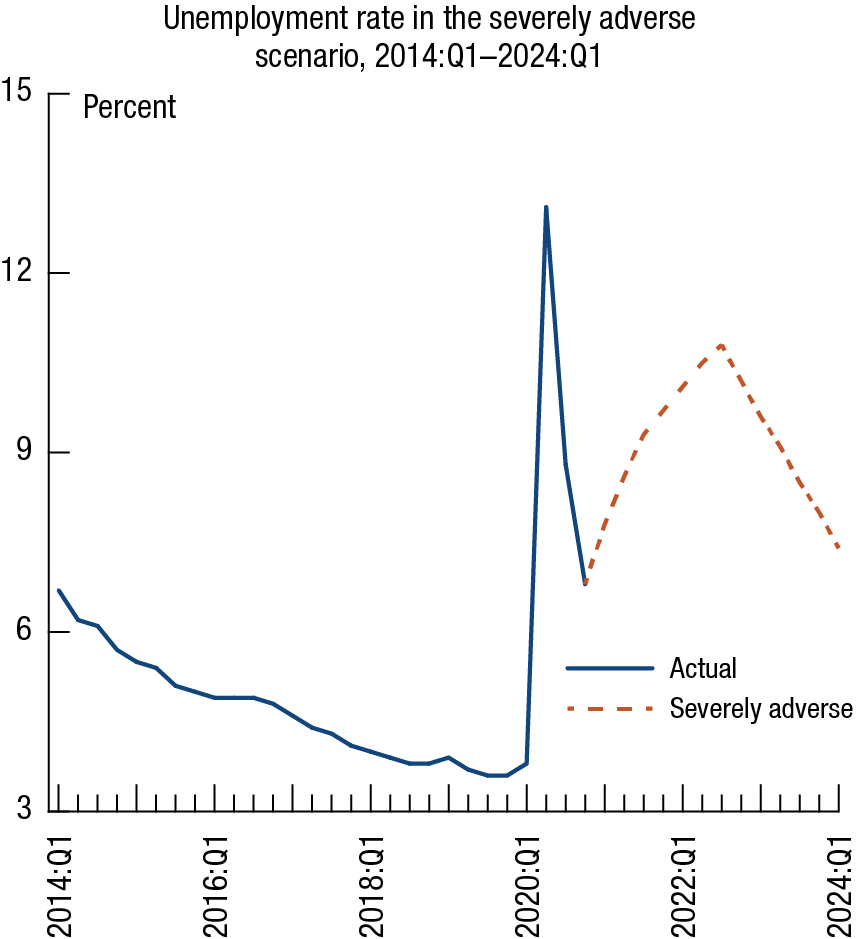

The hypothetical recession commences in the 1st quarter of 2021 and capabilities a extreme worldwide downturn with significant tension in business serious estate and corporate personal debt marketplaces. The U.S. unemployment rate in the “seriously adverse” state of affairs rises by four percentage factors from its starting up stage, reaching a peak of 10-3/four percent in the 3rd quarter of 2022. Gross domestic product or service falls four percent from the fourth quarter of 2020 as a result of the 3rd quarter of 2022, with asset price ranges dropping sharply, including a fifty five percent drop in equity price ranges. The chart under reveals the route of the unemployment rate:

This 12 months, 19 significant banks will be subject matter to the tension check. Smaller banks are on a two-12 months tension check cycle but can decide in to this year’s check and will have to do so by April five. Banking institutions with significant trading operations will be tested against a worldwide industry shock part that stresses their trading, private equity, and other honest value positions. Also, banks with significant trading or processing operations will be tested against the default of their largest counterparty. A table under reveals the parts that would apply to each and every financial institution, as effectively as identifying which banks are on a two-12 months cycle, dependent on details as of September 30, 2020.

The situations are not forecasts and the seriously adverse state of affairs is significantly much more extreme than most recent baseline projections for the route of the U.S. economic climate less than the tension tests time period. They are developed to assess the power of significant banks through hypothetical recessions, which is primarily appropriate in a time period of uncertainty. Each state of affairs contains 28 variables masking domestic and global economic exercise.

| Financial institution | Subject matter to 2021 tension check | Can decide in to 2021 tension check | Subject matter to worldwide industry shock | Subject matter to counterparty default |

|---|---|---|---|---|

| Ally Economical Inc. | X | |||

| American Express Company | X | |||

| Financial institution of The united states Company | X | X | X | |

| The Financial institution of New York Mellon Company | X | X | ||

| Barclays US LLC | X | X | X | |

| BMO Economical Corp. | X | |||

| BNP Paribas Usa, Inc. | X | |||

| Cash One particular Economical Company | X | |||

| Citigroup Inc. | X | X | X | |

| Citizens Economical Team, Inc. | X | |||

| Credit history Suisse Holdings (Usa), Inc. | X | X | X | |

| DB Usa Company | X | X | X | |

| Explore Economical Services | X | |||

| Fifth Third Bancorp | X | |||

| The Goldman Sachs Team, Inc. | X | X | X | |

| HSBC North The united states Holdings Inc. | X | X | X | |

| Huntington Bancshares Included | X | |||

| JPMorgan Chase & Co. | X | X | X | |

| KeyCorp | X | |||

| M&T Financial institution Company | X | |||

| Morgan Stanley | X | X | X | |

| MUFG Americas Holdings Company | X | |||

| Northern Have confidence in Company | X | |||

| The PNC Economical Services Team, Inc. | X | |||

| RBC US Team Holdings LLC | X | |||

| Areas Economical Company | X | |||

| Santander Holdings Usa, Inc. | X | |||

| Point out Street Company | X | X | ||

| TD Team US Holdings LLC | X | |||

| Truist Economical Company | X | |||

| UBS Americas Keeping LLC | X | |||

| U.S. Bancorp | X | |||

| Wells Fargo & Company | X | X | X |

Last Update:

February 12, 2021