Waller backs March Fed liftoff, Daly sees two or three 2022 hikes

Federal Reserve Governor Christopher Waller mentioned a more quickly wind-down of the U.S. central bank’s bond-obtaining method positions it to commence elevating curiosity rates as early as its March meeting to contain inflation that is “alarmingly substantial.”

“The full stage of accelerating the tapering was to conclude it considerably more quickly in March so the March meeting could be a stay meeting. That was the intent,” Waller mentioned Friday in reaction to a concern immediately after a speech to the Forecasters Club of New York. “It’s going to rely on what the data comes in, but March is a stay meeting for the to start with rate hike.” The Federal Open Market place Committee fulfills March 15-sixteen.

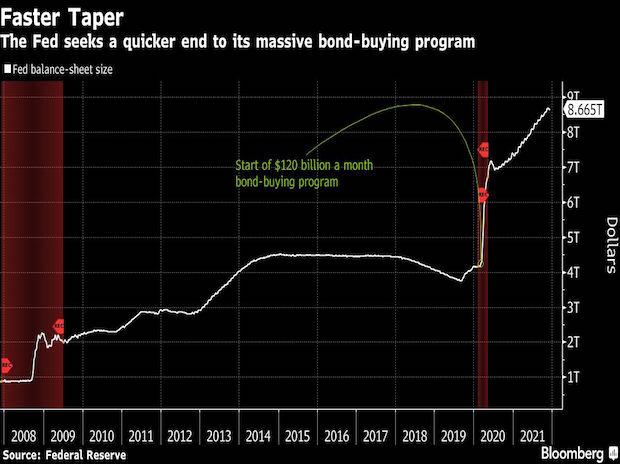

Fed Chair Jerome Powell and his colleagues agreed on Wednesday to double the speed at which they wind down their bond-obtaining method, placing them on observe to wrap it up by mid-March, and signaled they predicted three will increase in their benchmark federal money rate would most likely be suitable in 2022.

“My outlook is that it is a very probable result that it could happen in March,” Waller mentioned. “It would acquire some thing like extreme disruption from omicron to hold off labor sector advancement or retain unemployment from falling, to retain March from getting a vital day to consider of for liftoff.”

He was just one of three Fed officials speaking Friday as plan makers ended their post-meeting blackout on general public opinions.

San Francisco Fed President Mary Daly instructed an on the web celebration hosted by the Wall Street Journal that she predicted “two or three rate will increase following 12 months would be appropriate” if the omicron variant of Covid-19 doesn’t derail the financial restoration.

New York Fed chief John Williams independently mentioned greater rates following 12 months were being “likely,” including that “actually elevating curiosity rates would be a signal of a favourable enhancement in terms of where by we are in the financial cycle.”

When the Fed finishes the bond-obtaining method, it desires to make your mind up if it desires to manage the size of the stability sheet through reinvestment of maturing property, or start to let it shrink by allowing for them to run off.

Powell instructed reporters on Wednesday that a discussion had begun on the stability sheet but no decisions had been taken on when runoff would commence.

Waller mentioned he wished to go “sooner and faster” than past time — when the Fed waited three several years amongst ending the invest in method prior to beginning to let the stability sheet shrink — and argued this could possibly imply less rate hikes.

“If we commence performing some stability sheet runoff by summer time, that’ll acquire some strain off, you do not have to elevate rates very as considerably,” he mentioned. “My view is we really should commence performing that by summer time.”

He also favored finding the size of the stability sheet back to all-around twenty% of gross domestic merchandise versus 35% nowadays, with a concentration on increasing the share of Treasuries versus home loan-backed securities.

“I would like any runoff of MBS to be reinvested, if we’re performing reinvestment, back into quick-term Treasuries,” he mentioned.

In his speech, Waller mentioned he expects the U.S. economic climate and employment to continue expanding very strongly through at least the to start with fifty percent of following 12 months. Inflation “is alarmingly substantial, persistent, and has broadened to have an affect on far more classes of items and companies,” he mentioned.

Contacting the omicron variant of Covid-19 a “big uncertainty” for his outlook, Waller mentioned that it could aggravate labor and items source shortages and incorporate inflation pressures, likely derailing the moderation of price tag gains he predicted to see following 12 months.

Dear Reader,

Dear Reader,

Business enterprise Conventional has usually strived really hard to present up-to-day facts and commentary on developments that are of curiosity to you and have broader political and financial implications for the nation and the world. Your encouragement and continuous suggestions on how to strengthen our offering have only manufactured our resolve and determination to these ideals stronger. Even for the duration of these tricky moments arising out of Covid-19, we continue to stay committed to trying to keep you knowledgeable and up to date with credible information, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we fight the financial influence of the pandemic, we will need your guidance even far more, so that we can continue to supply you far more excellent articles. Our subscription product has seen an encouraging reaction from quite a few of you, who have subscribed to our on the web articles. More subscription to our on the web articles can only help us achieve the objectives of offering you even improved and far more pertinent articles. We feel in absolutely free, reasonable and credible journalism. Your guidance through far more subscriptions can help us practise the journalism to which we are committed.

Guidance excellent journalism and subscribe to Business enterprise Conventional.

Digital Editor