Total-return investing: A superior approach for income investors

In the present reduced-yield setting, income-oriented buyers could be tempted to look for for greater-yielding property to help their paying demands. However, in accordance to a just lately updated paper by Vanguard Investment Method Group (ISG), Whole Return Investing: A Sensible Reaction to Shrinking Yields, many buyers in search of income would be improved served if they adopted a complete return technique that spends by means of money returns in addition to portfolio income yield.

“The complete-return technique makes it possible for buyers to meet up with paying requirements without having relying only on portfolio yield,” stated Vanguard ISG’s Jacob Bupp, who alongside with David Pakula, Ankul Daga, and Andrew S. Clarke has revealed new get the job done based mostly on Vanguard study originally made by Colleen M. Jaconetti, Francis M. Kinniry Jr., and Christopher B. Philips. “It addresses portfolio construction in a holistic way, with asset allocation identified by the investor’s possibility-return profile.”

Just after the COVID-19 pandemic jolted monetary marketplaces in March 2020, the presently reduced yields on fixed income investments moved lower. At its 2020 reduced, the 10-yr Treasury observe yielded .52{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad}, a portion of its historical amounts.

“The reduced-yield setting poses a challenge to income-focused buyers who hope to use portfolio income to help paying,” Mr. Bupp stated. “Today, a broadly diversified portfolio of equity and fixed income can no more time generate a yield equal to four{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad} of the portfolio’s benefit, regular with regular rules for paying from a portfolio” (Figure one).

Figure one. Yields on conventional asset lessons fall below four{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad} paying target

Resources: Vanguard calculations, utilizing facts from Thomson Reuters Datastream.¹

Advantages and difficulties of conventional income strategies

An income-focused technique has usually been favored by buyers on the lookout to manage portfolio longevity. Shelling out is specifically dependent on the portfolio’s yield, so a elaborate paying technique is not required.

To meet up with conventional paying demands in the present reduced-yield setting, many income buyers will will need to regulate their asset allocations. But as the paper details out, these income-in search of strategies arrive with appreciable possibility, together with increased focus in dividend-focused equities and increased publicity to greater-yielding fixed income investments that behave a lot more like equities. Approaches these types of as these, which reach for yield, frequently direct to heightened volatility. (Figure two)

Figure two. A glimpse at greater-yielding asset lessons

“Tilting a portfolio towards greater-yielding property and away from conventional asset lessons only magnifies losses through moments of sector stress, together with the recent sector swings of early 2020,” Mr. Bupp stated (Figure 3).

Figure 3. Significant-yield property carried more draw back possibility early in the pandemic

Resources: Vanguard calculations, utilizing facts from Thomas Reuters Datastream.²

Whole-return investing: A improved technique

Mr. Bupp’s study also explores the benefits of a diversified complete-return technique.

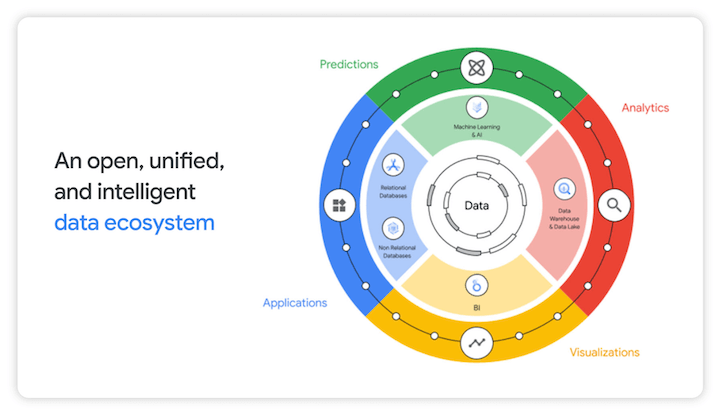

In contrast to conventional income strategies, the complete-return technique generates income from money gains in addition to portfolio yield. This technique starts with constructing a diversified portfolio matched to an investor’s possibility tolerance (Figure four).

When combined with a prudent paying rule, a complete-return investing technique has several strengths compared with the income technique:

- Portfolio diversification. Whole-return strategies are significantly a lot more diversfied across asset lessons. Diversified portfolios are likely to be less risky and keep up improved through stock sector shocks.

- Tax efficiency. Buyers with a complete-return technique could pay out less in taxes since component of their payment will come from money gains, which are taxed at a lower price than income.³

- More handle above the dimensions and timing of portfolio withdrawals. With a complete-return technique, buyers could have a lot more peace of thoughts since they can commit from money gains in addition to portfolio yield. Various scientific tests counsel that if you comply with a disciplined withdrawal system below a complete-return technique, your financial savings could previous a long time.

Figure four. Whole-return technique compared to income technique

“A complete-return technique can help to lessen portfolio challenges and manage portfolio longevity, whilst enabling an trader to meet up with paying ambitions with a mix of portfolio income and money,” Mr. Bupp stated. “We strongly suggest this technique, particularly through this interval of prolonged reduced yields.”

¹Yields are from January one, 1990, to August one, 2020. Asset lessons and their consultant indexes are: for international bonds, Bloomberg Barclays World-wide Aggregate Index USD Hedged for U.S. bonds, Bloomberg Barclays US Aggregate Index for international equities, MSCI Earth Index USD and for U.S. equities, MSCI United states Index. The well balanced portfolio is produced up of a mix of the indexes for U.S. bonds (35{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad}), international bonds (fifteen{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad}), U.S. equities (thirty{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad}), and international equities (20{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad}).

²Returns are from February 3, 2020, by means of March 31, 2020. Asset lessons and their consultant indexes are: for World-wide REITs, MSCI ACWI Diversified REIT Index for rising-sector bonds, Bloomberg Barclays EM Aggregate Index for international higher-dividend equities, MSCI Earth Significant Dividend Produce Index for international higher-yield bonds, Bloomberg Barclays World-wide Significant Produce Index for very long-period fixed income, Bloomberg Barclays Extended U.S. Corporate Index for globally diversified equity, MSCI AC Earth Index for globally diversified fixed income, Bloomberg Barclays World-wide Aggregate Index Hedged and for well balanced portfolio, 50{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad} equity/50{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad} bond allocation from MSCI AC Earth Index and Bloomberg Barclays World-wide Aggregate Index Hedged, respectively. All indexes are in USD.

³Qualified dividends are taxed at the money gains tax price, a lower price than the federal marginal income tax price.

Notes:

All investing is issue to possibility, together with the feasible reduction of the income you invest. Be conscious that fluctuations in the monetary marketplaces and other things could induce declines in the benefit of your account. There is no warranty that any certain asset allocation or blend of cash will meet up with your investment decision goals or offer you with a supplied amount of income. Diversification does not ensure a revenue or defend against a reduction.

Past overall performance is no warranty of upcoming returns. The overall performance of an index is not an exact illustration of any certain investment decision, as you can’t invest specifically in an index.

“Whole-return investing: A top-quality technique for income buyers”,