Metric of the Month: Invoices Billed to Customers With Credit Terms

Conclusions to extend or withhold credit history can be hard to make at any time and in any economic system. In a world pandemic and economic downturn, these conclusions can be even a lot more hard as enterprises battle to manage hard cash movement and continue to keep the lights on. Every single business would like to provide new shoppers in the door and push sales. But carrying out so in a way that does not in the end damage the business enterprise needs clever, thoughtful coverage and a willingness to acquire some chance.

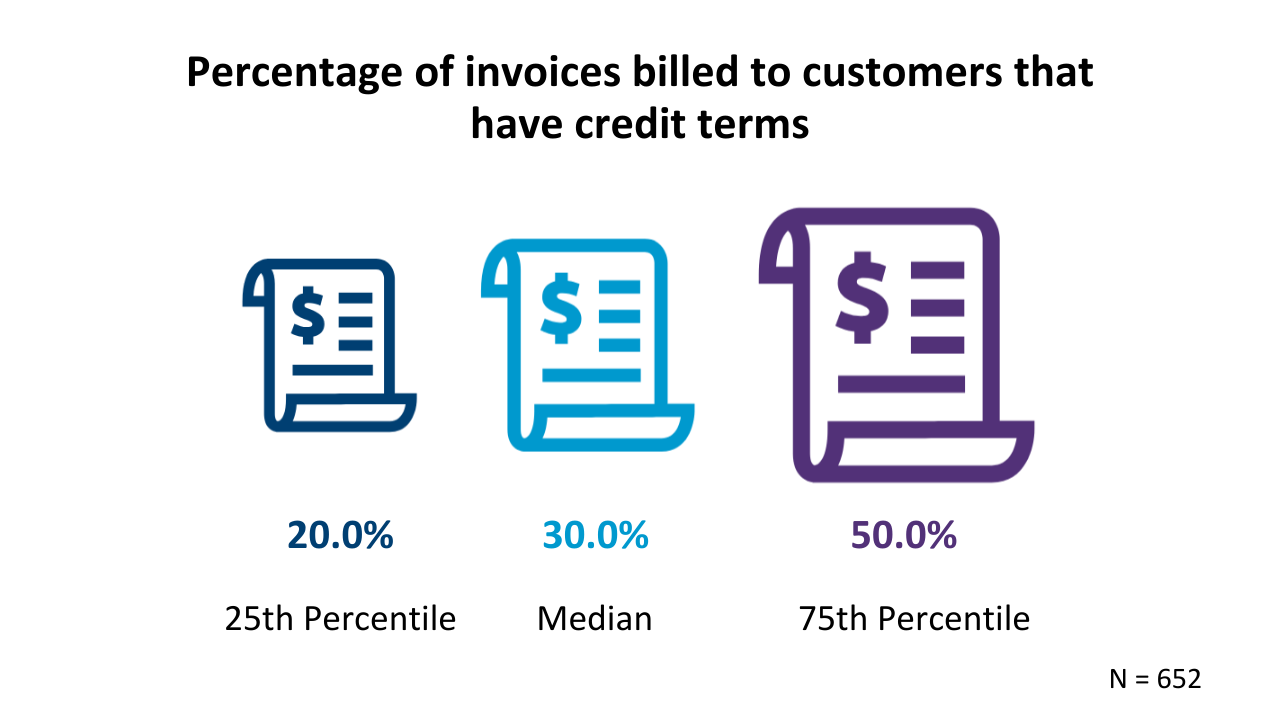

The volume of credit history that providers offer can change pretty a little bit, relying on field, dimensions, and fiscal power. As a result of its Open up Benchmarks Benchmarking Efficiency Evaluation in Customer Credit rating and Invoicing, APQC finds that respondents presenting the minimum volume of credit history (those in the twenty fifth percentile) invoice 20{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad} of their invoices to shoppers with credit history conditions. Respondents in the 75th percentile are a small a lot more than twice as generous with their credit history, billing 50 percent of their invoices to shoppers with credit history conditions (see graphic).

This cross-field benchmark involves a extensive assortment of providers, but some industries are by natural means a lot more credit history-hefty or credit history-averse. For case in point, couple shoppers — primarily in a pandemic and economic downturn — will wander into a automobile dealership with the hard cash on hand to pay back the full selling price of a car at the place of sale. It consequently can make feeling that automotive respondents at the 75th percentile invoice 83{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad} (or a lot more) of their invoices to shoppers with credit history conditions.

In the meantime, the health care field is typically fewer flexible about credit history, usually necessitating payment upfront for processes. Health and fitness care respondents at the 75th percentile invoice only 30{ae9868201ea352e02dded42c9f03788806ac4deebecf3e725332939dc9b357ad} of invoices to shoppers with credit history conditions. As normally, we advocate that you benchmark this and other measures in just your field for a sharper photograph of the place you stand relative to friends and opponents.

Weighing the Gains and Pitfalls

At a wide degree, credit history conclusions need a delicate balancing act. Credit rating guidelines that are far too lenient may expose a business to undue chance with increased quantities of shoppers unable to pay back. Policies that are far too restrictive, on the other hand, also carry chance simply because they may freeze out shoppers that normally would have experienced the capacity to pay back with credit history conditions. Every single business requirements to weigh the gains and tradeoffs versus aspects like chance hunger, strategic targets, and fiscal power. Finance leaders should really keep on being cognizant of the execs and drawbacks of extending credit history as they operate by way of those conclusions.

Rewards of Extending Credit rating

Credit rating plans can operate to a company’s benefit, furnished that the plan is backed up with a thoughtful coverage. If you can pay for it, the further payment choices made offered by way of credit history conditions can open up the door to new shoppers by creating it less complicated to invest in the product or assistance. Extending credit history can also push aggressive benefit, primarily if your competitiveness can not offer the very same payment choices. Existing shoppers, in the meantime, will enjoy obtaining a lot more versatility around payments and will be a lot more probable to keep on being faithful shoppers.

Problems of Extending Credit rating

Conclusions to extend credit history normally carry some volume of chance. Extending credit history to a lot more shoppers boosts the likelihood of late-having to pay shoppers or shoppers who can not pay back, which can place the brakes on your hard cash movement. It may also final result in increased fees down the highway, necessitating you to construct up your collections infrastructure (or else pay back a third occasion) to go after payments from shoppers that come across on their own unwilling or unable to pay back. It could possibly also lead to increased fees by way of enhanced uncollectable balances that subsequently require to be prepared off.

Know Your Buyers

When it arrives to conclusions about extending credit history, consumer know-how and relationships, potent guidelines, and finance equipment and technologies are all keys to achievements. Simply because of the operate that they carry out, some industries like banking and some top providers like Cargill leverage subtle analytics plans and workflow equipment to establish no matter if to extend or withhold credit history. And unquestionably, products and services that provide buyer or business enterprise-to-business enterprise credit history scores are valuable equipment, primarily when examining new shoppers. Analyzing current customers’ payment histories and behaviors can also help provide a clearer photograph of consumer conduct patterns and no matter if it is well worth the chance to give them a little bit longer to pay back.

There is also a relational component to some credit history conclusions that can not be dismissed. In particular for a company’s most strategic and mutually-advantageous relationships, it may be well worth compromising on credit history conditions. Your business enterprise and its workers are the priority, but keeping your most significant and valuable shoppers could possibly make it well worth accepting slower payments around time.

In an excellent planet, your business would get paid at the place of sale for each and every product or assistance it sells. Continue to, the truth is not likely to match this excellent — primarily in an economic system that continues to be battered by a pandemic. Specifically if you are in an field the place credit history is a required component of carrying out business enterprise, meticulously weighing the execs and drawbacks and producing clever guidelines will help lower the chance and help your business maximize the prospective prospect that arrives from obtaining a lot more shoppers on credit history.

Perry D. Wiggins, CPA, is CFO, secretary, and treasurer for APQC, a nonprofit benchmarking and most effective tactics exploration organization centered in Houston, Texas.